Standard Reports

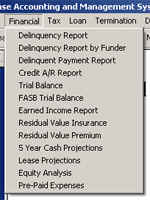

The Lease Accounting and Management System provides our customers with more than 80 different reports. Many reports may be sorted and printed in various ways. Report types include; management, transaction, financial, tax, loan, termination / inventory, dealer, salesman, tracking, general ledger and special forms. All reports may be run on an on-demand or recurring basis. On-demand reports provide a print preview with the ability to print selected pages or the entire report. Selected reports provide for the output of a comma-delimited (CSV) file which may be used by third party software such as Microsoft Excel® or Microsoft Access® for further manipulation by the user. A few of the available reports are described for you below.

Corporate Tax Report: Provides year-to-date and life-to-date information, on a lease-by-lease and summary basis with five-year projections. For Alternative Minimum Tax (AMT) requirements this report may be run with a specific depreciation type. The calculations used to generate this report are always kept up-to-date with the latest changes in Federal tax laws.

Cash Flow Report: Provides a detailed listing by lease, with summaries, showing projected cash flows for the next five years. If there is concurrent financing on the lease the report will show both lease revenue and loan expense for each period. Residuals will be shown as receipts when due and balloons as expenses when due.

Sales Tax Report: Provides detailed information by lease with summaries by tax authority and state. Each tax authority may have up to five additional breakdowns. For example your tax authority might be a county and within that county you may have a city tax, a transportation tax, a school tax and a special assessment. The Sales Tax Report will summarize each of these breakdowns.

End of Term Report: Provides a detailed listing by Company or by Marketing Rep of all leases coming to term between two user specified dates. Some of the information provided includes lessee name, phone number, asset description, maturity date and the residual value. This is an invaluable tool for lease end remarketing.

Posting Journal: Provides detailed and summarized information on every transaction that generates entries to the internal A.L.S. general ledger. The generation of this report can create an interface file to import into your corporate general ledger software. The A.L.S. software can interface to virtually any general ledger software that includes the ability to import data. The Posting Journal Report also generates a comma-delimited (CSV) file of posting journal information.

Delinquency Report: Provides a detailed listing of all delinquent leases. This report may be sorted in a number of different ways based on your collection preference. The report contains information such as lessee name, phone numbers, asset information, last payment date, details of outstanding charges, residual value amount and payoff as of the date of the report.

This is a small sample of the reports available with the system. For a complete list of included reports and samples, please request our sample reports package with your request for more information.

View Lease Software Features